Online travel company

Expedia Group, Inc. (NASDAQ: EXPE) stock has recovered through its pre-COVID February

pandemic highs tracking evenly with the performance of the benchmark

S&P 500 index (NYSEARCA: SPY). The COVID-19 epicenter travel and leisure industry stocks have been recovering dramatically lead by

airlines,

cruise shipsand

hotels. The market has placed a premium on shares with

COVID-19 vaccine distribution well underway despite the acceleration of global COVID-19 cases coupled with expanding lockdown restrictions. The question is whether a sell-the-news reaction sets in or shares continue to hold this higher base for another leg up as the market completely looks past COVID and onwards into the return to normalcy. Shares are overextended on the weekly charts so prudent investors should wait for opportunistic pullback levels to consider gaining exposure.

Q3 FY 2020 Earnings Release

On Nov. 4, 2020, Expedia released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) loss of (-$0.22) excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.79), a $0.57 beat. Revenues fell (-57.7%) year-over-year (YoY) to $1.5 billion beating analyst estimates for $1.37 billion. The Company noted that despite the “bumpy path to recovery” with rising COVID-19 cases, increased travel and continued progress with its cost initiatives enabled improved financial results.

Conference Call Takeaways

Expedia CEO, Peter Kern, indicated “We were pleased to see in the third quarter that we’re stabilizing travel trends and significant improvements on our cost structure, we were able to post markedly improved performance.” The Vrbo brand, a vacation rental platform competing with Airbnb (NASDAQ: ABNB), was very strong with YoY growth in Q3. North America hotel bookings held steady in July and continued to improve in Q3. Europe has been “rockier” due to the rising COVID-19 cases. Air travel continues to lag lodging especially international air travel but has also been steadily improving. North America is showing relative strength compared to Europe. Alternate lodging has been very strong, which has been evidenced by the Vrbo. CEO Kern noted that this, “has shifted lodging share significantly across geographies.” Expedia has used this downtime to expand existing partnerships on the B2B side as Kern notes, “We have expanded our partnership on the supply side with Marriott in terms of their wholesale distribution partnership, and we are spinning similar partnerships to optimize distribution with other chain partners.” The Company is “re-architecting” the platform for the future agility and starting to unlock benefits for the B2B business.

Cost Savings Initiatives

CFO Eric Hart provided updates on the cost savings initiatives that originally targeted $300 million to $500 million in fixed cost annualized savings at the start of the year. The Company is tracking “ahead of that amount” since last Q, identifying additional headcount reductions and incremental P&L efficiency opportunities in areas like real estate, software and licensing. Hart stated, “We are now targeting $700 million to $750 million in annualized run rate savings, compared to our 2019 exit rate. And we’ve already actioned over $550 million.” The Company is targeting variable cost savings in three areas including payments platform with reduced fees, customer service with virtual agents and marketing efficiency with higher ROIs. Cost of revenues were down (-40%) in Q3 YoY. The Company reported free cash flow of nearly $1 billion. As of the end of the third quarter, Expedia had unrestricted cash and short-term investments of $4.4 billion. The Company expects Q4 adjusted EBITDA to be negative and revenues to decline in a similar range of Q3. The cost savings has been impressive as well as the growth in Vrbo in the context of the pandemic backdrop. Shares gapped up dramatically on Nov. 9, 2020, on vaccine news. Prudent investors can watch for opportunistic pullbacks for exposure.

EXPE Opportunistic Pullback Levels

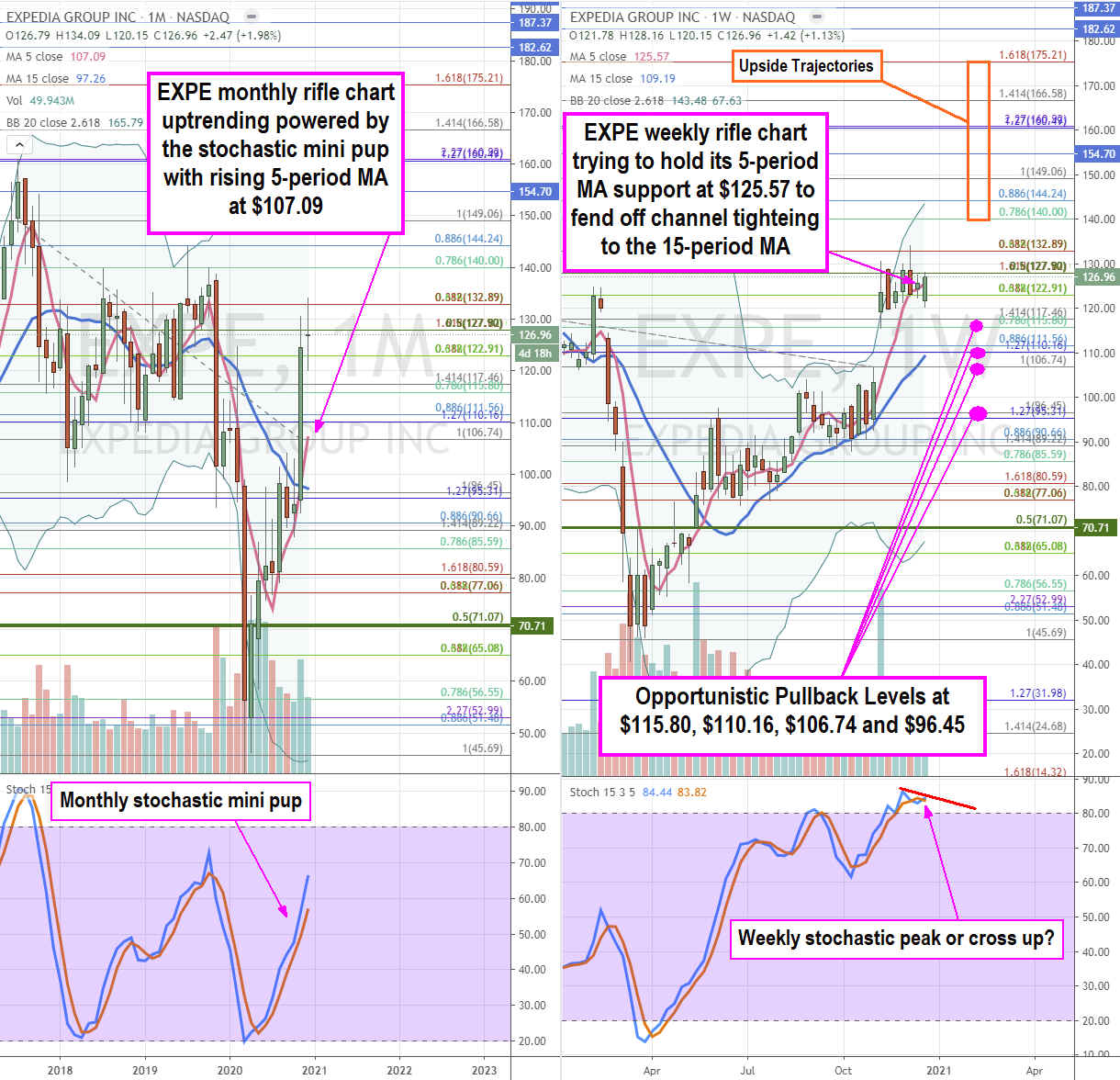

Using the rifle charts on the monthly and weekly time frames provides a broader view of the price action playing field for EXPE stock. The monthly rifle chart has a sharp uptrend that spiked to peak at the $132.89 Fibonacci (fib) levelas the 5-period moving average (MA) support is still trying to catch up at the $106.74 fib. The monthly stochastic mini pup triggered the 30% upside spike as shares gapped up through the $115.80 fib on the Pfizer (NYSE: PFE) vaccine news. The weekly rifle chart formed a market structure low (MSL) buy trigger above $70.71 in April 2020. The weekly stochastic formed an extended stairstep mini pup grind to possible peak out with a potential divergence top if it slips back under the 80-band versus a pup breakout if it crosses back up and holds the weekly 5-period MA at $125.57. Prices are too extended to chase as shares may have gotten ahead of themselves. Prudent investors may want to wait for opportunistic pullback levels at the $115.80 fib, $110.16 fib, $106.74 fib, and the $96.45 fib. The upside trajectories range from the $140 fib up to the $175.21 fib. It’s a good idea to watch peer Booking Holdings, Inc. (NASDAQ: BKNG) stock as a they tend to move together.

Companies in This Article: