By all rights, Intel (

NASDAQ:INTC) should be in seventh heaven right now. A global chip shortage is making pretty much every chip that rolls off its assembly lines all the more valuable, and as one of the leaders in the semiconductor field, it's got the ability to step in and save the day, which is worth a fortune in global good will. That's what makes its latest move so welcome, predictable, and even a bit disappointing.

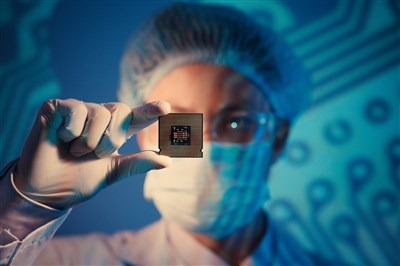

One Monster Investment to Tackle Chip Shortages

The latest word out of Intel features one monster investment. Indeed, a giga-investment; Intel plans to put $20 billion behind two of its currently-operational Arizona facilities. The $20 billion will go toward building two entirely new plants at the current facilities, which in turn will help get more supply to market. Ultimately, that should help get Intel more of the chip market.

This goes directly against some investors' hopes to see Intel pivot out of chip manufacture altogether to instead focus on chip design, letting other companies do the heavy lifting of actually making the chips in question. Intel's new CEO, Pat Gelsinger, made it pretty clear that any such plans were out of the picture, noting that “Intel is back. The old Intel is now the new Intel.”

This shift essentially converts Intel into what's called an “integrated device manufacturer”, in that it has a much tighter control over the entire process of chip-making from design to manufacture. Reports suggest that the closest comparison at this point is to Samsung (OTCMKTS:SSNLF), and that's not a bad thing to be compared to, overall.

The Analyst Pool is Steady, if Steadily Skeptical

One of the amazing things about Intel—as based on our latest research—is the sheer stability of its overall rating. The company has held a consensus “hold” rating for the last two years running, the research reveals, and the ratios that makeup said hold have shifted very little in the interim.

A year ago, the company had 18 “buy” ratings, 12 “hold”, and 11 “sell” ratings to its credit. Six months ago, the ratio was unchanged at 18 “buy”, 12 “hold” and 11 “sell.” Three months ago, the ratio was unchanged once more, and didn't really start changing until about a month ago. Today, meanwhile, the ratio stands at 14 “buy”, 14 “hold” , and 11 “sell” ratings.

The price target, meanwhile, has seen many more ups and downs in its overall line, but has held the line fairly steadily in the $45 to $64 range for most of the last year. The latest average price target for the company is $61.68, which is fairly close to Intel's current share price of $63.45 as of this writing.

Too Much, Too Late?

There's one big problem with Intel's planned move to get back into chip fabrication, and with extreme diligence: the duration. Intel expects the new facilities to be up and running by 2024. Considering we're not too far into 2021 yet, that means about another three years to go. Either Intel expects the chip shortage to carry on for another three years, or Intel has not considered the notion that smaller, more nimble firms will enter the market at any point in the next three years and start seizing market share.

Give Intel credit where it's due, however; the company isn't just looking to take on the chip shortage. It's looking beyond that, bringing in what it calls “Intel Foundry Services”. Under such a plan, Intel will actually be building chips for other companies. It actually puts Intel on the other side of the changes that some investors wanted to see in Intel previously; while many companies design chips, and then turn to factories like those held by Taiwan Semiconductor Manufacturing Company (NYSE:TSM) or, again, Samsung to build the chips, Intel Foundry Services actually makes Intel the chip-builder to other companies' designs.

That puts Intel into a pretty unique position, and one that may actually be helpful going forward. Instead of being held hostage by a slowdown in chip manufacture, now Intel can be part of the solution, driving forth construction and putting more chip supply in the market. Plus, it's no longer dependent on devices using Intel chips, as it manufactures the chips that are in others' devices. This almost puts the company into a shovels-in-a-gold-rush position, as the worldwide demand for chips only increases and Intel has a direct hand in putting more of them in play.

While the time-to-launch is a bit of a problem, and opens up threat from outside interests looking to eat Intel's lunch, the fact that Intel is going full-bore back into chip-building is a welcome development. Throwing some investment behind Intel now may get you early access to one of the biggest new developments in the semiconductor market in years.

Companies in This Article: