Beverage producer Keurig Dr. Pepper (NASDAQ: KDP) shares have been underperforming the benchmark S&P 500 index (NYSEARCA: SPY) as they peaked out in late July and has been decelerating since. The maker of popular beverage brands including Green Mountain Coffee, Dr. Pepper, A&W Root Beer, Schweppes and Snapple saw a surge due to the narrative of being a stay-at-home pandemic winner taking market share away from Starbucks (NASDAQ: SBUX) and Dunkin Brands (NASDAQ: DNKN) . As the restart narrative accelerates, shares have been decelerating and still trades largely under the radar in the shadows of the major beverage makers like Coca Cola (NYSE: KO), Pepsi Co. (NYSE: PEP) and Monster Energy (NASDAQ: MNST). A closer look at the metrics indicate that at-home single-serve coffee consumer market share gains are indeed stickier than perceived. While consumers can be fickle with their spending, they are also creatures of habit. The pandemic has reshaped how consumers shop, dine and drink. Prudent investors that believe in the stickiness of consumer habits can view the recent pullbacks at opportunistic entry levels while the misunderstood narrative exists.

Q2 FY 2020 Earnings Release

On July 30, 2020, Keurig released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported an earnings-per-share (EPS) profit of $0.33 excluding non-recurring items versus consensus analyst estimates for a profit of $0.32, beating estimates by $0.01. Revenues rose 1.8% year-over-year (YoY) to $2.86 billion falling beating $2.81 billion consensus analyst estimates. Strong growth in Green Mountain brand coffee pods of 9.5% YoY and brewer volume growth of 19% YoY was powered by the pandemic triggered work-at-home trend. The pandemic accelerated household penetration, which can continue to be sticky. This strength was partially offset by the contraction in hospitality businesses. Management reaffirmed guidance for full-year 2020 EPS of $1.38 to $1.40 versus $1.38 consensus. The full-year 2020 revenue guidance was raised 3% to 4%. The Company also moved its listing to the NASDAQ on Sept. 21, 2020 while keeping the same stock symbol.

Share Dilution

On Aug. 18, 2020, Keurig announced a secondary offering of 45 million shares from selling shareholder Maple Holding at $29.15 per shares, which is majority owned by privately held JAB Holdings (which originally acquired Green Mountain Coffee). On Sept. 11, 2020, Mondelez International (NASDAQ: MDLZ) announced it sold 12.5 million shares of KDP stock to lower its active stake down to 11.2% (from 12.1%).

Q2 2020 Conference Call Takeaways

Keurig Dr. Pepper CEO, Robert Gamgort, pointed out how the Company has exceeded performance expectations for sales growth of 2% to 3% and adjusted EPS growth of 15% to 17% in the eight quarter since the merger. This equates and an average 20% annual growth rate while reducing management leverage ratio from 6X to 4X. Gamgort proceeded to highlight milestones such as being the first company to combine both hot and cold beverages at scale. The Company gained 1.2 share points in the carbonated soft drink (CSD) market in the second quarter thanks to innovations like Dr. Pepper & Cream Soda, which was the best performing innovation in the CSD category for the year. Dr. Pepper has grown for 17 consecutive quarters while Canada Dry has seen growth for 17 straight years.

(Still) Dominating Single-Serve Drink Market

The single-serve coffee market was literally created by Green Mountain Coffee 16 years ago. The Company continues to have a “commanding leadership position” of the single-serve K-Pod coffee market at 82% through a combination of licensed, partnered and owned brands. The coffee pod segment grew 9.5% and brewer sales grew 11.6% in YoY in Q2 2020. This was fueled by new households entering the system primarily due to the pandemic stay-at-home mandates. E-commerce grew to 10% of total sales in the quarter.

Leveraging Distribution Network

The Company owns one of the largest beverage distribution networks, with no interest in renting but partnering the system. Long-term partnership with Danone for Evian brand and licensing agreement with Peet’s Coffee are examples. The Company recently partnered with third-largest branded flavored sparkling water maker Polar Seltzer in a long-term franchise agreement. The Company will help expands its distribution as its only available in less the 35% of the stores domestically but is the highest velocity sparkling water where sold. Polar will distribute Keurig Dr. Pepper brands through their international networks. The Company is seeing great success with the launch of its Keurig Dual Brewers and plans to launch Keurig Mini and Smart Brewers for the upcoming holiday season.

Next-Gen K-Customer Smart Brewers

“The K-Custom Smart Brewer is compatible with existing K-Cup Pods and has the capability to recognize the specific brand, variety and roast for any owned, license or partner brand made by Keurig and brew to the specification of its master roaster to bring out the full flavor.”, according to Gamgort. These Smart Brewers can be configured and controlled by smart phone to turn on with an alarm and have coffee brewed perfectly remotely. It can keep track of metrics and reorder pods when they run low. The pandemic helped expand market share with the at-home coffee drinking segment. The dominant position of its K-Cup single-serve market long after patents expired is a testament to the stickiness of its network of consumers. Prudent investors can watch for opportunistic pullback opportunities ahead of the next-gen rollout and strong holiday season pipeline rollout.

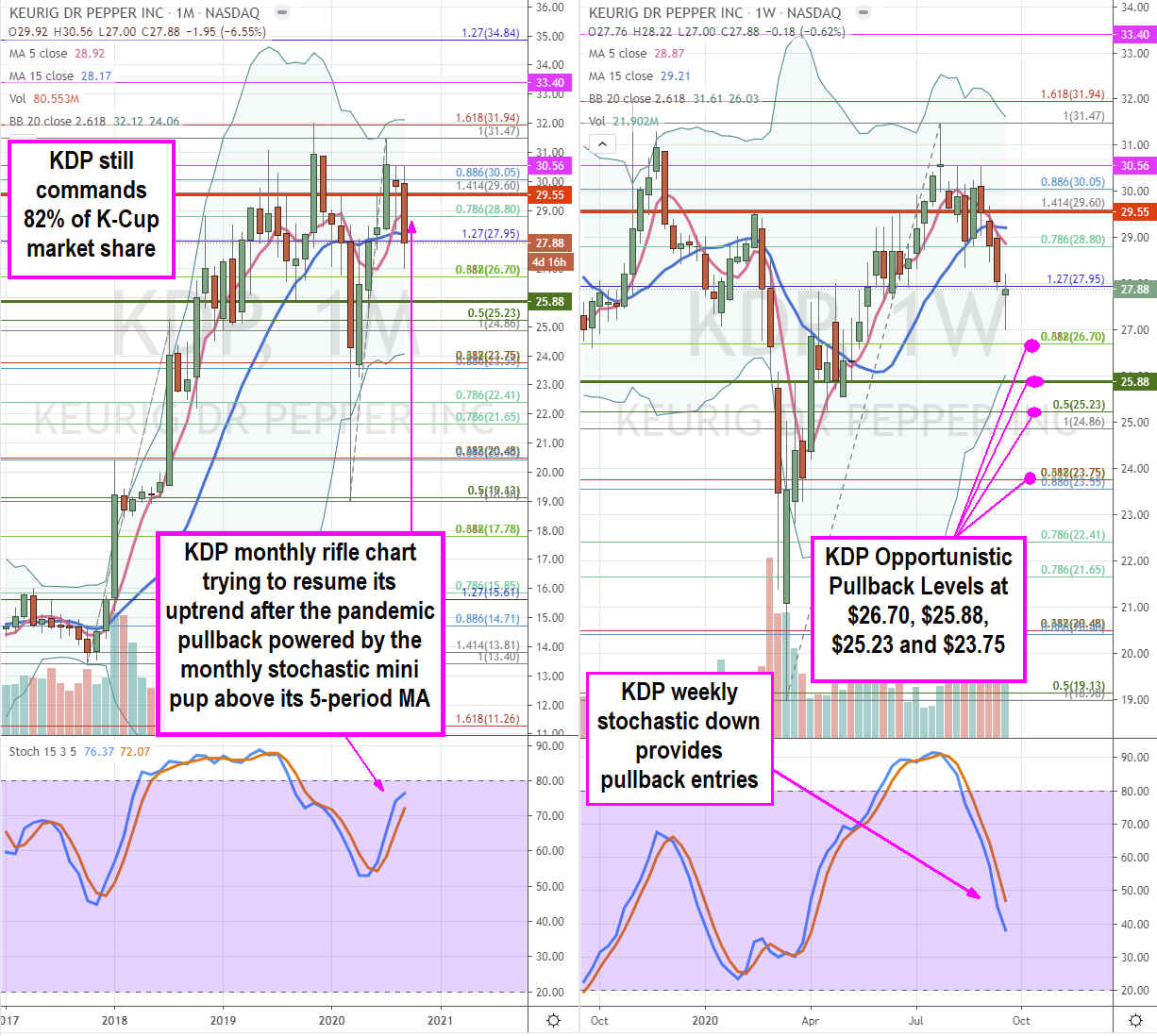

KDP Opportunistic Pullback Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for KDP stock. The monthly rifle chart has a stochastic mini pup that can trigger above its 5-period moving average (MA) at the $28.88 Fibonacci (fib) level. The weekly rifle charts triggered a market structure low (MSL) buy above $25.88. However, the weekly stochastic is oscillating down after triggering the weekly market structure high (MSH) when it fell under $29.55. This is providing opportunistic pullback levels are at the $26.70 fib, $25.88 weekly MSL, $25.23 fib and $23.75 monthly lower Bollinger Band (BB) and overlapping fib.

Companies in This Article: