Business workflow solutions provider

Slack Technologies, Inc. (NASDAQ: WORK) stock can’t seem to sustain positive traction as it underperforms the benchmark

S&P 500 index (NYSEARCA: SPY). Originally seen as a

pandemic benefactor gaining from the

work-at-home trend, analysts had high hopes for

Zoom Video (NYSE: ZM) type of blow out numbers. While the business still

exhibits strong growth, it has underwhelmed analysts for the past three-quarters as illustrated by the sharp post-earnings sell-offs. This has placed the bar low heading into the Q3 2020 results. The Company has rolled some out new innovations since and could break the familiar sell-the-news reaction this time around. Prudent investors can watch for opportunistic pullback price levels ahead of or after the earnings release.

Q2 FY 2021 Earnings Release

On Sept. 8, 2020, Slack released its fiscal second-quarter 2021 results for the quarter ending July 2020. The Company reported an earnings-per-share (EPS) of breakeven excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.03), a $0.03 beat. Revenues grew 48.9% year-over-year (YoY) to $215.9 million, beating analyst estimates for $209.22 million. Calculated billings grew 25% YoY to $218.2 million but actually slowed from a peak pace of 38% in the prior quarter. The Company has taken actions to support smaller business customers facing headwinds in the pandemic by offering, credits, installment billing and shortened contracts. Paid customers grew 30% YoY to 130,000 with 125% net dollar retention rate. Customer accounts with more than $100,000 annual recurring revenues grew 37% YoY to 985.

Conference Call Takeaways

Slack CEO, Stuart Butterfield, provided details for more color behind the numbers. He noted that net new paid customers grew faster in June and July versus the April and May pandemic peaks. This may indicate a new growing baseline rate. While part of it was attributed to work from home, Butterfield points out the improvements in the self-service experience, improvements to paid conversion with new trial offer promotions and the June launch of Slack Connect, which enables up to 20 companies to share a single channel. Slack Connect grew its paid customer based to 52,000 from 41,000 the prior quarter.

Mixed Q3 2021 and FY 2021 Guidance

For Q3 fiscal 2021, Slack issued in-line EPS guidance range of (-$0.06) to (-$0.05) versus (-$0.05) consensus and revenues of $222 million to $225 million versus $224.23 million consensus estimates. The Company raised full-year 2021 guidance to an EPS range of (-$0.14) to (-$0.13) versus (-$0.22) consensus estimates. Revenues for full-year fiscal 2021 are expected to come in between $870 million to $875 million versus $847.91 million analyst estimates and breakeven cash flow. analyst estimates and breakeven cash flow. Historically, it takes several years for new customer to hit “their peak revenue contribution”. Slack Connect is a key growth driver for both new paid customer acquisition and retention driver for existing customers. This has spurred growth in the number of connected endpoints from 140% YoY growth in Q4 2019 to over 200% in Q2 2021. Slack Connect has compelled many endpoints that were non-paid or non-Slack customers to upgrade after taking a trial referred by an existing customer. The March trials resulted in 8,000 new paid customers in Q2. The new batch of trial conversion driven by Slack Connect should convert in Q3 as trials expired at the end of June. The Company added 17 new million-dollar customers in the first half for total of 87 total, up 78% YoY. Small business customers affected by downsizing and cancellations stemming from the pandemic were offset by Enterprise customer growth. Butterfield reiterated that paid customer additions are the core driver of long term growth driven by platform innovations.

The Bar Has Been Set Low

Stock prices tend to have muscle memory around scheduled binary events like earnings releases. The bar for Q3 fiscal 2021 has been set low with the flat guidance. Shares tend to rise into the earnings release and triggers a sell-the-news reaction afterward. The same template may play out again unless shares get sold ahead of the earnings at which point an inverted patten may play out especially if they beat the in-line numbers. Prudent investors should monitor opportunistic pullback price levels for exposure heading into and after the Q3 fiscal 2021 release.

WORK Opportunistic Pullback Levels

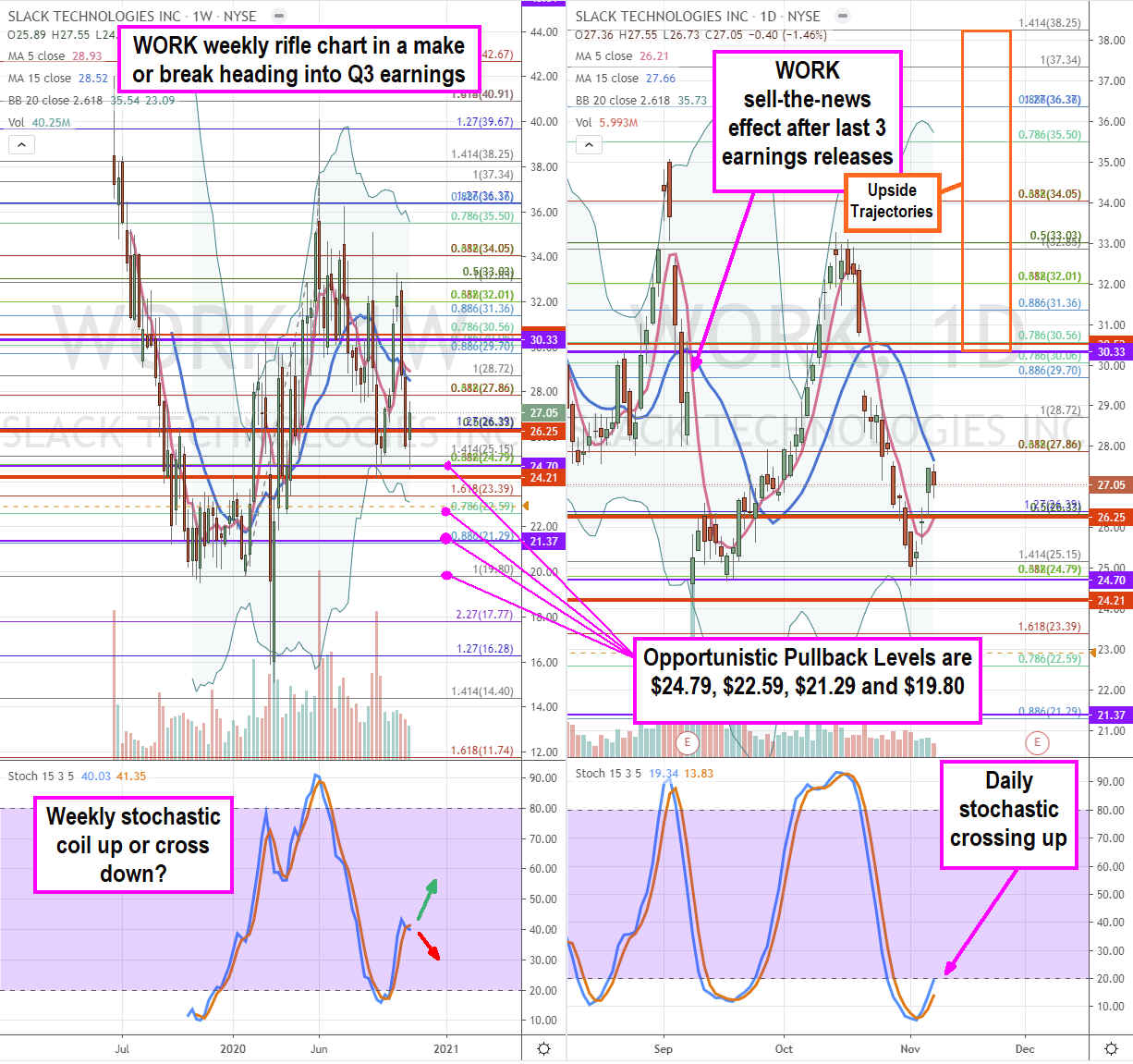

Using the rifle charts on the weekly and daily time frames enables a precise view of the playing field. WORK has historically rose ahead of its earnings release and sold off viciously afterwards. Whether this all-too transparent pattern repeats again depends on the weekly make or break. The weekly rifle chart can form an inverse pup breakdown if shares reject off the 5-period moving average (MA) at the $28.72 Fibonacci (fib) level. The weekly market structure low (MSL) buy triggered on the $21.37 breakout in late March. The daily stochastic formed a full oscillation down to form a double bottom off the $24.70 fib for a stochastic cross up attempt at the 20-band. A pullback off the daily 15-period MA or breakdown through the 5-period MA can present opportunistic pullback levels at the $24.70 fib, $23.59 fib, $21.29 fib and the $19.80 fib. The upside trajectories range from the $30.33 MSH trigger to the $38.25 fib. If shares run up ahead of the Q3 2020 release, then wait for a sell-the-news reaction. If shares hit pullback levels, then watch for a bounce after the release.