Business process automation software and services provider

Exela Technologies (NASDAQ: XELA) stock has been brought onto radars as

meme stock momentum mover. A peek under the hood reveals Xela as a billion-dollar company with over 18,000 employees. The Company provides

enterprise transaction processing,

document management and digital process services globally. The thin 35.5 million share float make it prone to periods of high volatility as volume can spike up to 500 million shares a day during these periods. Keep in mind the Company did execute a 1-for-3 reverse split resulting in a float of 59.2 million shares outstanding. Bears argue the Company is a sinking ship being crushed by its debt, dwindling revenues, thin margins, asset sales, and shareholder dilution (entered into another at-the-market equity program for $150 million, after completing a $100 million ATM on June 30, 2021) with more issuance of shares. Nearly 41% of the workforce is outsourced to India and the Philippines but U.S. data laws preventing data transfer across borders may lead to wage inflation to maintain and capture lucrative banking contracts. Shares recently saw a large spike on news of having options contracts available for trading as of July 16, 2021. Shares have seen fallen nearly 50% since recent peaks. Speculators looking for a play on BPA and the

return to normal for enterprises can watch for opportunistic pullback levels to gain exposure.

Fiscal Q1 2021 Earnings Release

On March 10, 2021, Exela released its fiscal first-quarter 2021 results for the quarter ended March 2021. The Company reported adjusted EBITDA of $46.5 million on revenues of $300.1 million. Gross profit margin was 22.5%. up 250 basis points year-over-year (YoY). Operating income was $4.3 million compared to a loss of (-$2.2 million) in year ago same period. Net loss was (-$39.2 million) versus a loss of (-$12.7 million) in Q1 2020. The SMB business showing 117% growth in DMR customers and DrySign user grew 170%. The Company recently signed a cloud-hosted deployment of PCH Global platform with a major insurer for $90 million in a 10-year licensing agreement. As a result of its BPA solutions, the Company has been able to reduced employee headcount to 18,400 as of March 31,20201 down from 19,000 in December 2020. The Company raised $26.8 million in gross proceeds in its equity offering. The Company ended the quarter with $62 million in liquidity and total debt of $1.48 billion.

CEO Comments

Exela Technologies CEO Roger Cogburn stated, “We are pleased with the strong expansion of both our gross margin and adjusted EBITDA margin in the first quarter, which reflects our ongoing commitment to focus on our core businesses and drive continued operational improvement. We are also impressed with the adoption of the various Digital Assets Group solutions in the SMB and enterprise markets. Based on our first quarter results and the momentum we see in the business. We reiterate our prior 2021 guidance”

Conference Call Takeaways

CEO Cogburn set the tone, “We delivered multiple key new business wins and solution launches in the first quarter as well. With respect to the new business wins our recent expansion into the small and medium business market showed strong growth in Q1, 2021. SMB customers for our digital mailroom solution grew 117% sequentially in Q1 and our SMB DrySign users increased almost 170%. This is the kind of adoption we were looking for. Our pipeline continues to grow in this segment, and we have plans for further global expansion of this business.” DrySign is Company’s signature processing software similar to DocuSign (NASDAQ: DOCU) and a growth engine. He noted that enterprise customer contracts tend to be five to 10 years with annual maintenance, renewal, and support fees. The Company plans to bring more subscription-based business processes to the SMB market in the U.S. Europe and Asia. He concluded, “With over 30 years of experience we serve 4,000 plus customers globally including 60% of the Fortune 100, Exela's customers across verticals such as banking, insurance, commercial, healthcare, and public sector rely on a fully deployed technology stack, the 140 plus delivery centers and over 18,000 employees to execute mission-critical business processes.”

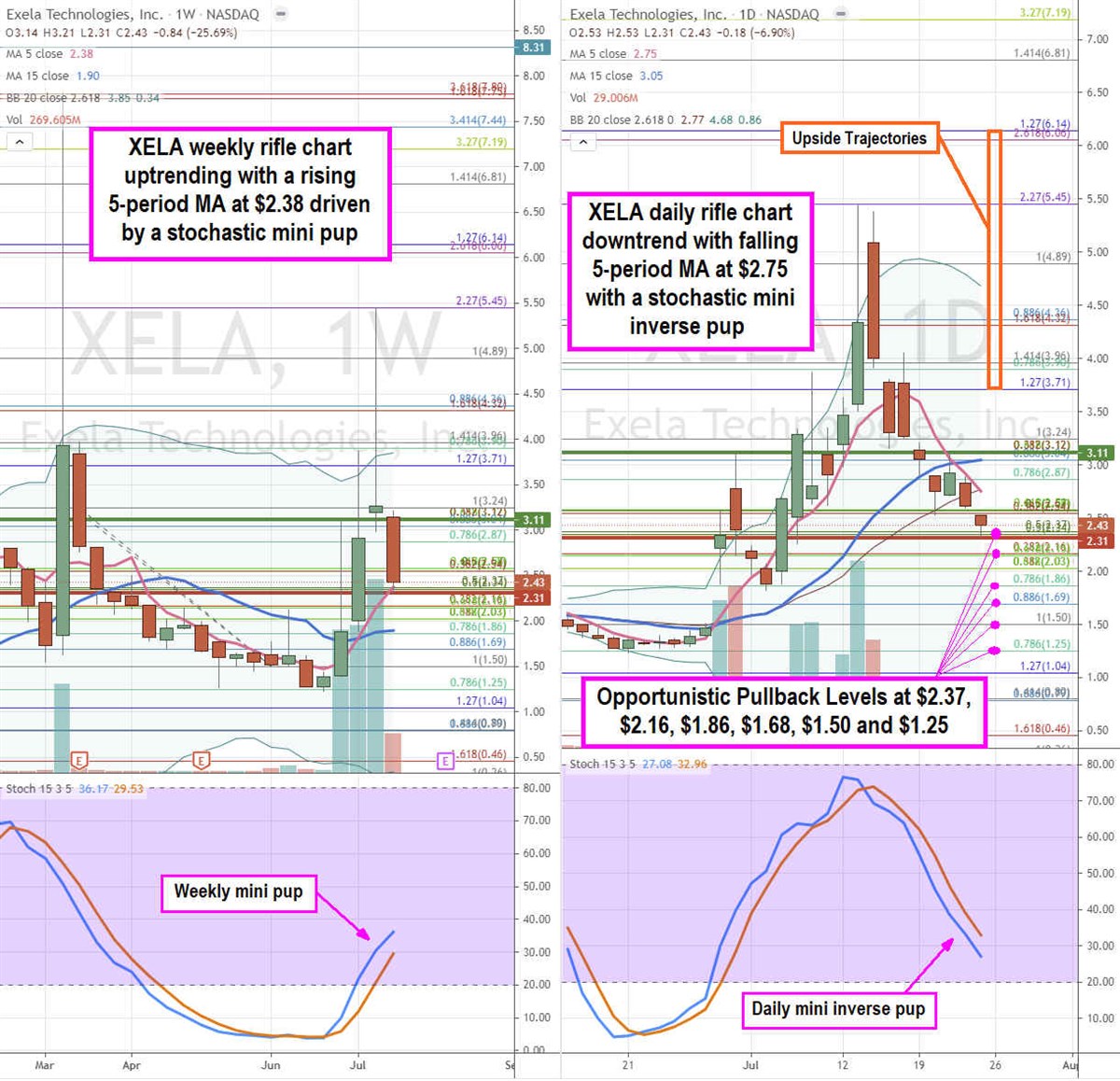

XELA Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for XELA stock. The weekly rifle chart uptrend has a rising 5-period moving average (MA) support at $2.38 Fibonacci (fib) level. It also overlaps with the $2.31 weekly market structure high (MSH) sell trigger. The weekly market structure low (MSL) buy trigger on a breakout back up through $3.11. The weekly upper Bollinger Bands (BBs) sit near the $3.90 fib. Shares are prone to large heavy volume spikes as seek on $5.45 fib peak on the most recent spike. The daily rifle chart shows the aftermath as shares broke down into a downtrend with a falling 5-period MA at $2.75 and lower daily BBs at $0.86. The daily stochastic has a mini inverse pup oscillating towards the 20-band. Prudent investors can monitor for opportunistic pullback levels at the $2.37 fib, $2.16 fib, $1.86 fib, $1.68 fib $1.50 fib, and the $1.25 fib. Upside trajectories range from the $3.71 fib level up to the $6.14 fib.

Companies in This Article: