Residential homebuilder

Tri Pointe Home (NYSE: TPH) stock has been grinding to all-time highs on the continued

housing boom as demand outstrips supply notably in single-family homes. With low interest rates, continued federal programs supporting first-time buyers and rising materials costs, the trend is expected to continue. The

pandemic spawned the resurgence in demand for single-family homes as stay-at-home mandates forced office closings. It forced the adoption of the

work-from-home trend fueling the migration of workers into the

suburbs. The acceptance and adoption of work-from-anywhere will help accelerate the demand for homes as the notion of the

elastic office is now a reality and part of the “new normal”. With a price-earnings (P/E) ratio of just over 10, Tri Pointe is also one of the cheapest homebuilders on the market. Prudent investors looking for a value play in the residential homebuilding sector can monitor shares of Tri Pointe Homes for opportunistic pullbacks to scale into a position.

Q1 2021 Earnings Release

On April 22, 2021, Tri Pointe released Q1 Fiscal 2021 results for the quarter ending in March 2021. The Company reported earnings per share (EPS) of $0.59 excluding non-recurring items, beating consensus analyst estimates of $0.47, by $0.12. Revenues rose 20.5% year-over-year (YoY) to $716.70 million, missing analyst estimates for $736.24 million. Net new home orders rose 20% YoY. Backlog units grew 56% YoY. Gross margins rose to 23.9%.

Q2 2021 and Full-Year Guidance

The Company estimates delivering 1,500 to 1,600 homes being delivered in Q2 2021 at an average sales price between $630,000 to $640,000. Average gross margins will range between 22% to 23% and SG&A expense will come in between 10% to 10.5% with an effective tax rate around 25%. The Company expects to open approximately 70 new communities in full-year 2021 for a total of 120 to 130 active selling communities. Tri Pointe expects to deliver between 6,000 to 6,300 homes at an average price of $625,000 in 2021, with gross margins ranging between 22% to 23%. CEO Doug Bauer proclaimed, “Tri Pointe Homes delivered record breaking results in the first quarter of 2021, including the best order performance and home sales gross margin result in our Company’s history… Net new home orders in quarter increased 20% year-over-year, thanks to a 49% improvement in our absorption pace as demand for new homes continues to far outstrip supply in most of our markets.”

Conference Call Takeaways

CEO Bauer set the perfect tone, “We’ve been a leader in green building since 2001 and out commitment is always expanding, incorporating the latest innovative design, materials and technologies in the LivingSmart for homes and communities… The combination of powerful millennial demographic forces, low existing inventory levels, favorable mortgage rates, and years of underbuilding has led to real supply demand imbalance that has taken the nation’s need for new housing supply to new heights. The intensified demand for new homes brought about by the pandemic continues unabated as we see life beginning to normalize. Simply put, we are in the midst of one of the strongest housing markets in my career.” Nailing it right on the head, he continued, “We continue to take advantage of the robust demand with ongoing price increases and reduced incentives, allowing us to stay ahead of the cost inflation we are experiencing on a number of front.” CEO Bauer noted that gross margins for home deliveries came in at 23.9%, up 340 basis points YoY, all while lowering SG&A by 250 basis points.

High Quality Homes for Highly Qualified Buyers

Tri Pointe also caters to the well qualified buyer with its premium homes with an average FICO score of 748 and debt-to-ratio income of 26% and loan-to-value ratio of 82%. The Company already owns or controls 37,000 lots thanks to assertive early investing, one to three years ago before the boom. The Company has over $1 billion in total liquidity including $585 million in cash and cash equivalents. Tri Pointe also has the green factor which adds the element of environmental, social and governance (ESG) to the shares and further appeals to the millennial demographic.

TPH Opportunistic Pullback Levels

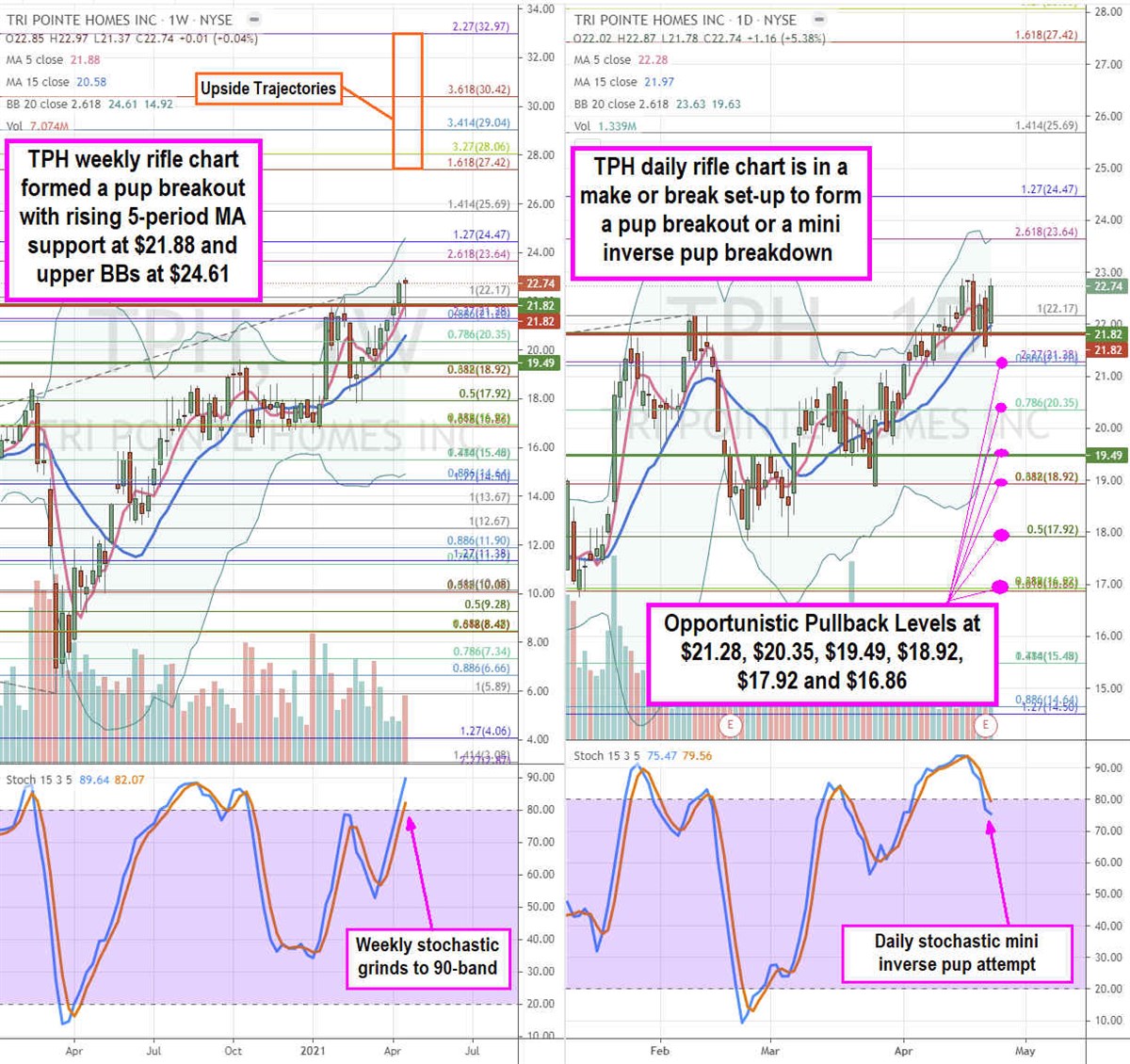

Using the rifle charts on the weekly and daily time frames provides a precision view of the near-term playing field for TPH shares. The weekly rifle chart formed a pup breakout with a rising 5-period moving average (MA) support at $21.88 targeting the upper Bollinger Bands (BBs) at the $24.47 Fibonacci (fib) level. The pup breakout originated on the market structure low (MSL) trigger above $19.49. The daily rifle chart uptrend has peaked and stalled forming a market structure high (MSH) sell trigger on a breakdown below $21.82. The daily stochastic also peaked and formed a mini inverse pup that has fallen under the 80-band and stalled as the make or break sets up while the daily 5-period MA at $22.28 tightens the distance with the 15-period MA at $21.97. From here, the bull case is a daily pup breakout as the stochastic crosses back up through the 80-band towards the $23.64 upper BBs. The bear case is a stochastic mini inverse pup breakdown as the daily 5-period MA crosses down through the 15-period MA causing the stochastic to form a deeper oscillation towards the 20-band. Prudent investors can monitor for opportunistic pullback levels at the $21.28 fib, $20.35 fib, $19.49 fib, $18.92 fib, $17.92 fib, and the $16.86 fib. The upside trajectories range from the $27.42 fib up towards the $32.97 fib level.

Companies in This Article: